The Cross-Investment Network in AI: Bubble or Real Transformation?

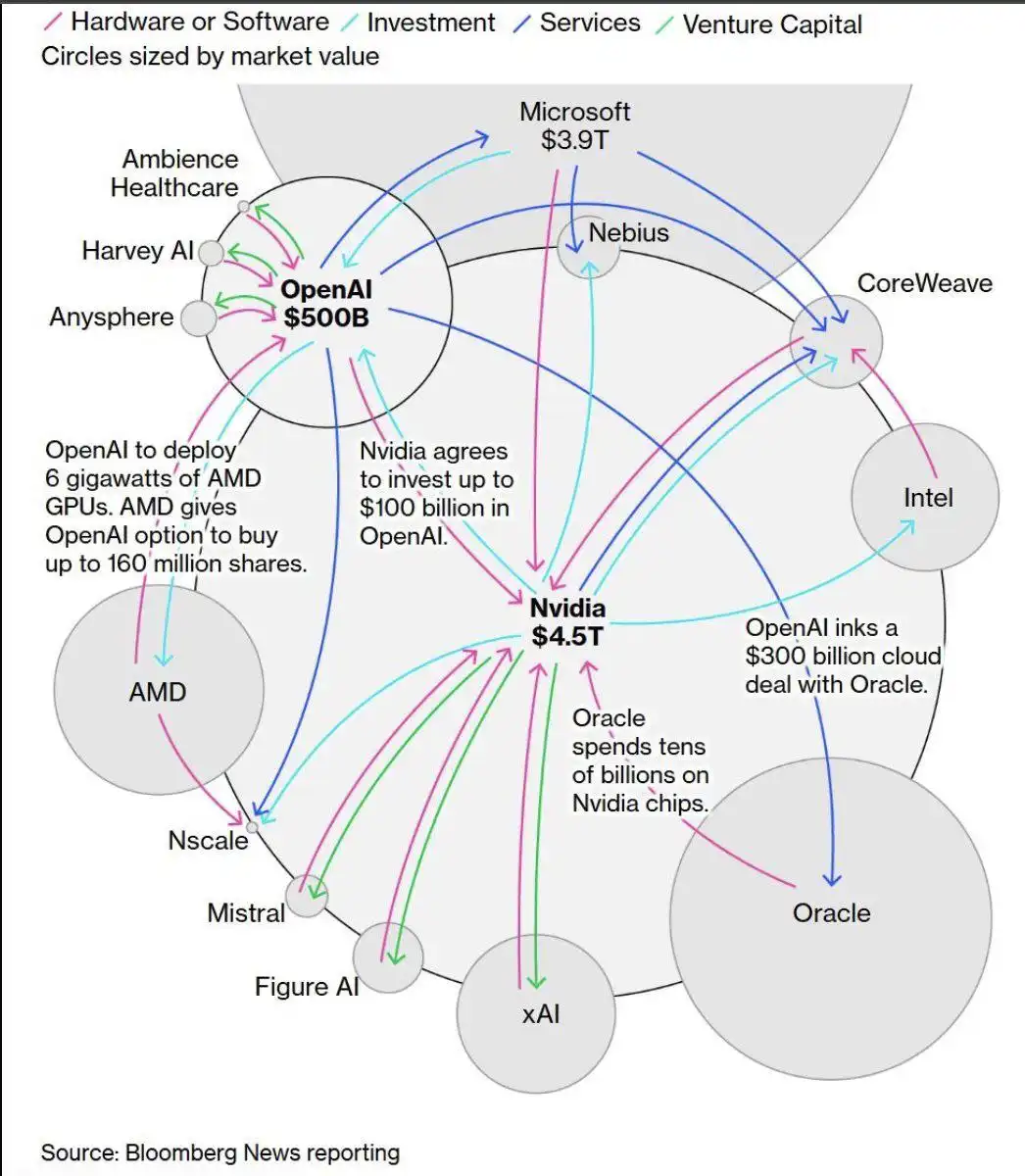

The artificial intelligence investment ecosystem is creating a network of financial interdependencies without precedent. OpenAI, valued at $500 billion, sits at the center of a web where major tech players invest in each other in a circular fashion.

The Anatomy of the Network

The investment structure reveals interesting patterns:

- Microsoft invests billions in OpenAI and owns 49%

- OpenAI signs $300 billion cloud contracts with Oracle

- Oracle buys chips from Nvidia for tens of billions

- Nvidia in turn agrees to invest up to $100 billion in OpenAI

- OpenAI will deploy 6 gigawatts of AMD GPUs

- AMD offers OpenAI purchase options for up to 160 million shares

This interdependence creates an ecosystem where each player reinforces the other’s position, but also generates systemic vulnerabilities.

Valuations vs. Economic Reality

Financial metrics show a notable disconnect. OpenAI projects $11.6 billion in revenue for 2025, which places its valuation at approximately 43 times its projected revenue.

For context: Apple, with consolidated and massive profits, trades between 7-8 times its revenue. The difference signals expectations of exponential growth or, potentially, speculative overvaluation.

The Lesson from the Dot-Com Bubble

This situation has instructive parallels with the dot-com bubble of 1999-2000. Then, as now, valuations soared above 40 times projected revenue, based on promises of technological transformation.

What Happened After the Burst

When the dot-com bubble exploded in 2000-2002:

- 78% of internet companies disappeared

- $5 trillion in market valuation was lost

- But others like Amazon, Google and eBay survived and prospered

The key difference: companies that built real value applications for real users not only survived, but dominated the next decade.

Amazon wasn’t the most valued e-commerce company in 2000. But it was the one that best solved the problem of buying online. Google didn’t have the biggest investment in search engines, nor did it even invent pay-per-click advertising. But it had the best search algorithm and the way to monetize it.

Applications vs. Infrastructure

The dot-com bubble -and others like mobile networks- teaches that infrastructure follows an advanced cycle that overvalues it in the early phases of a technological revolution. In contrast, practical applications are underestimated.

In the current cycle:

- Overinvestment: AI hardware, computing capacity, base models.

- Potential underinvestment: Specific applications that solve concrete problems.

Once again, it’s in value-added applications where the opportunity lies.

Three Possible Scenarios

From where we are now, three possible scenarios arise:

Scenario 1: Soft Landing

Valuations adjust gradually. AI infrastructure costs drop. Access is democratized. Practical applications flourish and increasingly need less hardware.

Scenario 2: Sharp Correction

A confidence crisis deflates valuations rapidly. Speculative players go bankrupt and it seems like “all AI is a bluff.” But those with real products consolidate positions.

Scenario 3: New Dominant Infrastructure

The massive bet on computing capacity creates a new layer of digital infrastructure. Like what happened with Amazon Web Services after the bubble, but this time much more concentrated and also intervened by states, due to the geopolitical interests at stake.

The most likely outcome is a combination of scenarios 2 and 3.

What Matters for Companies

Regardless of the scenario, the principles are clear:

Value over valuation: Companies that generate measurable ROI with AI will have constant demand, regardless of market fluctuations.

Specific applications: Vertical solutions for concrete industries will outperform generic tools. The technology is already mature for real applications.

Pragmatic adoption: It’s not about waiting for the “perfect moment” or betting on the best-valued company. It’s about identifying processes that AI can optimize today; enter even with training and go step by step.

Value is the Only Thing That Counts

Companies that are building specific solutions for particular industries around process automation, applied predictive analytics, operational optimization, etc. are creating sustainable value.

And on the other hand, customers who benefit from those applications also acquire strategic and practical knowledge of AI that will be a competitive advantage. And all of this regardless of market valuations.

The unknown is not whether the bubble will explode or when it will happen, but whether you’ll be on the right side of the curve when it does.

Chart source: Bloomberg News